Madrid, March 18, 2022 – Eve UAM, LLC, an Embraer company, and Acciona, a global company leader in the provision of regenerative solutions for a decarbonized economy, today announced a strategic partnership to accelerate the development of a global and sustainable Urban Air Mobility ecosystem. Under the terms of the partnership, upon the consummation of Eve’s business combination with Zanite Acquisition Corp., Acciona will invest US$30 million and will join the group of strategic investors that are currently supporting the development of Eve and its business plan. As part of the agreement, José Manuel Entrecanales, Acciona’s Chairman and CEO, will become one of the seven members of the Board of Directors after Eve’s listing on the New York Stock Exchange (NYSE), which is expected to happen in the second quarter of 2022.

“Whether we like it or not, the world’s population is increasingly concentrating in larger cities. Keeping the climate footprint of these urban areas at bay is one of the greatest challenges of the decarbonization process we are all engaged in,” said José Manuel Entrecanales. “Urban air transport models such as the one proposed by Eve can be very useful when considering different sustainable mobility solutions. Participating in a project as innovative as Eve will allow us to continue advancing along that path.”

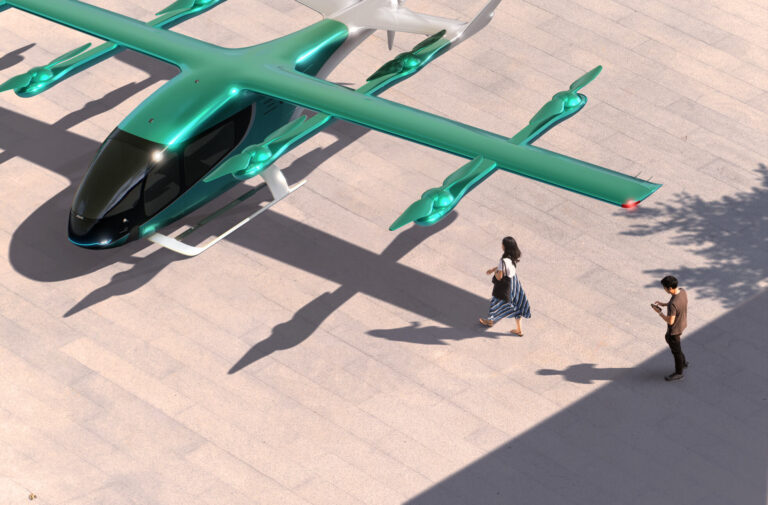

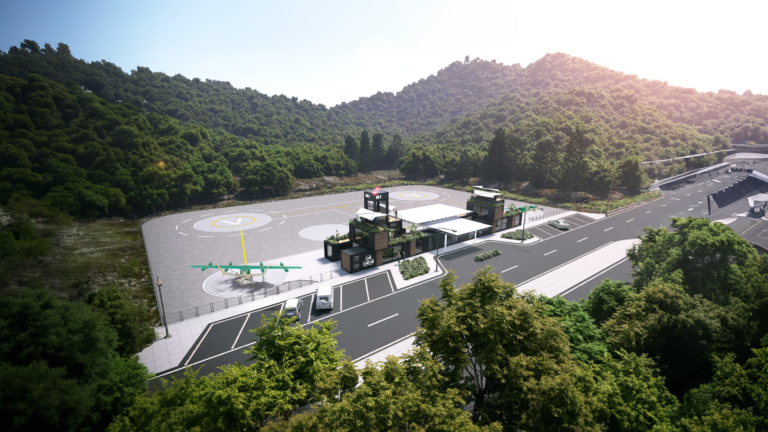

“Our agreement with Acciona reinforces Eve’s commitment to delivering a sustainable UAM ecosystem, which includes not only our zero-emission eVTOL – electric vertical takeoff and landing vehicle – but also the green infrastructure that will support this new way of transport. Its capability to build these infrastructures, added to its top credentials in sustainability, bring essential skills and expertise to the business that will help us to maintain our distinction in the market,” said André Stein, co-CEO of Eve.

The partnership will also benefit novel industrial initiatives in the development of a sustainable UAM ecosystem, including vertiports, power purchase agreements, battery charging solutions, and handling. In 2021, 93% of the Acciona Group’s investments were aligned with the European Union’s taxonomy for sustainable activities. The company avoided the emission of 13.4 million tonnes of CO2 (+1.5%) during the year, ending that year as the most sustainable electricity company in Spain and the second most sustainable worldwide, according to the Sustainability Yearbook 2022 published by S&P Global.

In December 2021, Eve announced [prnewswire.com] plans to list on NYSE through a business combination with Zanite Acquisition Corp. (Nasdaq: ZNTE, ZNTEU, ZNTEW), a special purpose acquisition company focused on the aviation sector. Upon the closing of the transaction with Zanite, Zanite will change its name to Eve Holding, Inc. and its common stock and warrants are expected to trade on NYSE under the new ticker symbols “EVEX” and “EVEXW”, and Eve will become a wholly owned subsidiary of Eve Holding. So far Eve has attracted a group of complementary strategic investors that bring an unparalleled set of capabilities spanning the Urban Air Mobility (UAM) ecosystem, including fixed-wing operators (Republic Airways and SkyWest), aircraft lessors (Azorra and Falko), financing (Bradesco BBI) and technology (Rolls-Royce and Thales) providers, as well as players in the defense industry (BAE Systems). The business combination values Eve at an implied US$2.4 billion enterprise value and Embraer will remain a majority stockholder with an approximately 82% equity stake in Eve Holding following the closing of the business combination.

Follow Eve and Embraer on Twitter: @EveAirMobility @Embraer

About Acciona

Acciona is a global company, a leader in the provision of regenerative solutions for a decarbonized economy. Its business offer includes renewable energy, water treatment and management, eco-efficient transportation and mobility systems, resilient infrastructures, etc. The company has been carbon neutral since 2016. Acciona recorded sales of €8.1 billion in 2021 and has a business presence in more than 60 countries.

About Eve Air Mobility

Eve is dedicated to accelerating the Urban Air Mobility (UAM) ecosystem. Benefitting from a startup mindset, backed by Embraer’s more than 50-year history of aerospace expertise, and with a singular focus, Eve is taking a holistic approach to progressing the UAM ecosystem, with an advanced eVTOL project, a comprehensive global services and support network and a unique air traffic management solution. For more information, please visit www.eveairmobility.com.

About Embraer

A global aerospace company headquartered in Brazil, Embraer has businesses in Commercial and Executive aviation, Defense & Security and Agricultural Aviation. The company designs, develops, manufactures and markets aircraft and systems, providing Services & Support to customers after-sales.

Since it was founded in 1969, Embraer has delivered more than 8,000 aircraft. On average, about every 10 seconds an aircraft manufactured by Embraer takes off somewhere in the world, transporting over 145 million passengers a year.

Embraer is the leading manufacturer of commercial jets up to 150 seats and the main exporter of high value-added goods in Brazil. The company maintains industrial units, offices, service and parts distribution centers, among other activities, across the Americas, Africa, Asia and Europe.

Important Information and Where to Find it

In connection with the proposed business combination among Zanite Acquisition Corp. (“Zanite”), Embraer, Eve and Embraer Aircraft Holding, Inc. (“EAH”), Zanite has filed with the Securities and Exchange Commission (“SEC”) a preliminary proxy statement (as amended by Amendment No. 1 to the preliminary proxy statement, filed on February 9, 2022) relating to the business combination. When available, Zanite will mail a definitive proxy statement and other relevant documents to its stockholders. This press release does not contain all the information that should be considered concerning the proposed business combination and is not intended to form the basis of any investment decision or any other decision in respect of the business combination. Zanite’s stockholders and other interested persons are advised to read the preliminary proxy statement and the amendments thereto and the definitive proxy statement, when available, and documents incorporated by reference therein filed in connection with Zanite’s solicitation of proxies for its special meeting of stockholders to be held to approve the business combination and other matters, as these materials contain or will contain important information about Zanite, Eve and the business combination. When available, the definitive proxy statement and other relevant materials for the business combination will be mailed to stockholders of Zanite as of a record date to be established for voting on the business combination. Stockholders of Zanite may obtain copies of the preliminary proxy statement, the definitive proxy statement (when available) and other documents that have been or will be filed with the SEC or that are incorporated by reference therein, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to Zanite Acquisition Corp. at 25101 Chagrin Boulevard Suite 350, Cleveland, Ohio 44122, Attention: Steven H. Rosen, or by calling (216) 292-0200.

Forward-Looking Statements Disclosure

This press release contains “forward-looking statements.” Forward-looking statements represent Eve’s, Embraer’s and Acciona’s current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “project,” or “continue,” or other similar words. These statements are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements regarding the potential consummation of the strategic partnership with Acciona and the business combination with Zanite, as well as any other statement that does not directly relate to any historical or current fact. Forward-looking statements are based on current assumptions about future events that may not prove to be accurate. These statements are not guaranteed and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict. Many factors could cause actual results to differ materially from these forward-looking statements. As a result, these statements speak only as of the date they are made, and neither party undertakes an obligation to update or revise any forward-looking statement, except as required by law. Specific factors that could cause actual results to differ materially from these forward-looking statements include the effect of global economic conditions, the ability of the parties to negotiate and enter into a definitive agreement and realize anticipated synergies, the ability of Eve to obtain the required certifications to manufacture and sell its eVTOL aircraft, and other important factors previously disclosed in the section entitled “Risk Factors” in Zanite’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 and other documents of Zanite filed, or to be filed, with the SEC, all of which are accessible on the SEC’s website at www.sec.gov.

No Offer or Solicitation

This press release is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an applicable exemption from the registration requirements thereof.

Participants in the Solicitation

Zanite and its directors and executive officers may be deemed participants in the solicitation of proxies from Zanite’s stockholders with respect to the proposed business combination. A list of the names of those directors and executive officers and a description of their interests in Zanite is contained in Zanite’s Registration Statement on Form S-1/A and by Zanite’s Current Report on Form 8-K filed on September 15, 2021, each of which was filed with the SEC and is available free of charge at the SEC’s web site at www.sec.gov, or by directing a request to Zanite Acquisition Corp. at 25101 Chagrin Boulevard Suite 350, Cleveland, Ohio 44122, Attention: Steven H. Rosen, or by calling (216) 292-0200.

Eve, Embraer, EAH and their respective directors and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of Zanite in connection with the proposed business combination. Additional information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of Zanite’s stockholders in connection with the proposed business combination, including a description of their direct and indirect interests, by security holdings or otherwise, which may be different than those of Zanite stockholders generally, may be obtained by reading Zanite’s preliminary proxy statement (as amended by Amendment No. 1 to the preliminary proxy statement, filed on February 9, 2022) for the proposed business combination and, when it is filed with the SEC, the definitive proxy statement and any other relevant documents that are filed or will be filed with the SEC relating to the proposed business combination. Stockholders, potential investors and other interested persons should read the preliminary proxy statement carefully and, when it becomes available, the definitive proxy statement and any other relevant documents that are filed or will be filed with the SEC relating to the proposed business combination before making any voting or investment decisions. These documents can be obtained free of charge from the sources indicated above.